Hit enter to search or ESC to close

25 August 2025

H1 2025 Review

Softening market continues

As we previously reported, the New Zealand insurance market has been softening and this trend has continued through the first half of 2025.

In most insurance sectors, policies are now being offered for renewal at expiring or lower than expiring premiums. Similar market conditions are being experienced worldwide, despite increasing climate-related claims and continuing geo-political instability.

Weather disasters dominate claims

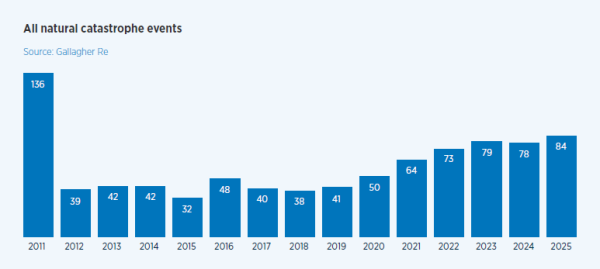

The year started with the terrible Californian wildfires and the global disasters continued. The first half of 2025 saw US$84bn in insurance claims caused by natural catastrophes including storms, floods, cyclones and earthquakes.

Munich Re, one of the world's biggest reinsurers, noted that 98% of natural catastrophic insured losses in 2025 related to weather disasters, with the second highest insured losses since their records began in 1980.

In the past 14 years, only the first half of 2011 was more costly for the insurance market than 2025, as highlighted in the above graph. The 2011 losses were driven by Japan's calamitous earthquake and tsunami and, of course, our own devasting earthquake in Canterbury.

In March 2025, Cyclone Alfred unleashed extreme rainfall in Australia, leading to serious flooding in Queensland and New South Wales. Overall losses were estimated at US$3.5bn of which US$1.4bn was insured.

New Zealand has also been lashed by wild weather with states of emergency declared in Nelson, Tasman, Marlborough and Canterbury due to severe flooding. Many other regions have also experienced extreme rain and wind events and three tornadoes have been reported so far this year.

So why are premiums reducing?

With all these factors causing significant insurance losses, it can be quite difficult to correlate why insurance premiums appear to be reducing.

Essentially it all comes down to supply and demand. At the top of the insurance pyramid is the reinsurance market. Reinsurance is protection that is purchased by primary insurance companies to safeguard their balance sheets. Gallagher Re reported that the global reinsurance capital has hit a peak of US$769bn and that reinsurers are currently on track to deliver healthy ROEs in the mid-teens for 2025, with traditional reinsurance capital set to increase by another 6% (assuming average results for the rest of the year).

Locally, Suncorp (Vero) and IAG (NZI) have both reported significant profits for the 2025 financial year resulting from benign claims activity in New Zealand.

Over the past few years, reinsurers and insurers, locally and globally, have reset their business models to account for the expected increasing losses from climate change.

This resulted in premium increases for most insurance buyers from 2022 to the end of 2024.

While insurance losses have increased, so has the insurance premium pool. Gallagher New Zealand records show how the average premium spend per client in our commercial portfolio has changed over four years:

| Period | Average premium per client |

% change |

| Jan to Jun 2022 | $10,566 | - |

| Jan to Jun 2023 | $12,011 | 13.7% |

| Jan to Jun 2024 | $13,160 | 9.6% |

| Jan to Jun 2025 | $12,321 | -6.4% |

Despite a 6.4% decline in average premium spend during the first half of 2025, spending this year remains nearly 16% higher than in 2022. While some of this increase can be attributed to inflationary effects on sums insured, it also reflects the growth in the overall national premium pool.

However, the market is finely balanced. A run of several significant natural disasters could tip things back the other way. From an insurance and reinsurance perspective, the financial performance of any year is often defined by what happens during the Atlantic hurricane season that runs from June through November each year.

The National Oceanic and Atmospheric Administration (NOAA) in the US has predicted the 2025 season has a 30% chance of a near-normal season, a 60% chance of an above-normal season and a 10% chance of a below-normal season. NOAA is forecasting 13 to 19 named storms and of those, 6 to 10 will become hurricanes with 3 to 5 of these being major hurricanes.

Local insurance market outlook remains positive

The impact of the hurricane season is unlikely to affect insurance market conditions in New Zealand in 2025. Most insurers in New Zealand have their reinsurance programmes locked down until at least the end of the year. Any change in the global reinsurance market, whether positive or negative, is unlikely to be felt here before 2026.

Conditions for insurance buyers are expected to remain positive for the rest of 2025. There will be pockets where there is more pressure – flood-prone risks, risks with poor loss histories and challenging industry sectors etc – but overall, it is a stable outlook.

For more insights, read the full report.