Hit enter to search or ESC to close

26 November 2025

Insurance Market Update November 2025

Despite some recent wild spring weather events in New Zealand, the insurance market is still experiencing a very benign claims environment meaning the soft market conditions continue to prevail in most sectors of insurance.

Premiums hold steady at favourable levels

The current market conditions have led to increased competition among insurance companies, resulting in ample capacity and more competitive premiums for insurance buyers. These conditions first emerged in Q3 2024 and are now firmly established, with no signs of easing unless a major catastrophic event occurs locally or internationally to increase premiums.

The claims environment

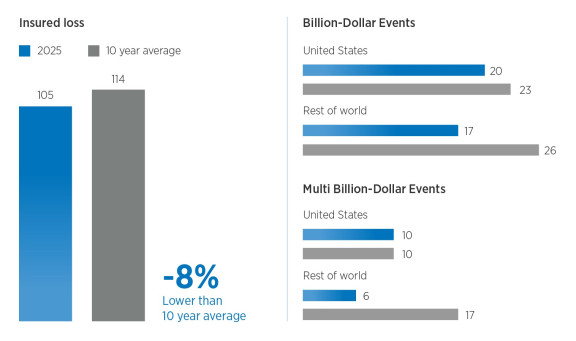

New Zealand is not the only country where insurance claims in volume and value have been lower than average. Globally, natural catastrophe insured losses for Q1-Q3 2025 were US$105bn. This is the lowest number since 2019 and compares to the 10 year rolling average of US$114bn.

This is despite the year starting with the terrible wildfires in California that resulted in insured losses of US$40bn. These below average loss totals are also largely due to quieter than expected tropical cyclone activity in the Atlantic and Pacific Oceans.

Strong financial health of reinsurers and insurers

As a result, global reinsurers are in good financial health, with margins around 17.7%. Such attractive returns are resulting in more investment into the market and global reinsurance dedicated capital rose to US$805bn in H1 2025 - a significant increase.

For local New Zealand insurers, reinsurance is a major operating expense. This increased supply of reinsurance capacity has driven down prices, thereby reducing their costs.

Reduced reinsurance costs, coupled with lower than expected claims, has meant New Zealand insurance companies are making increased profits across their portfolios, even as premiums are reducing. A good example of this is NZI’s financial results as of 30 June 2025 showed a 2.6% drop in overall premiums (NZ$1.861bn to NZ$1.812bn) but their reported insurance margin had improved from 23.3% to 24.3%.

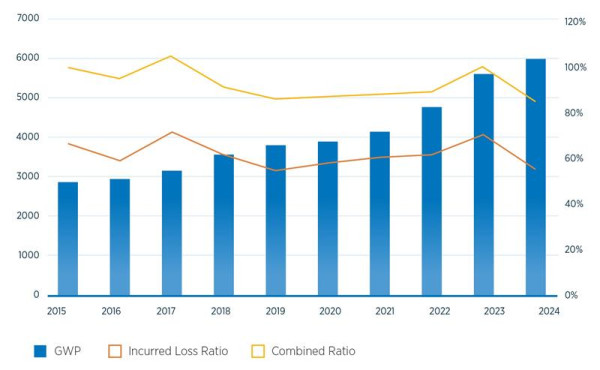

This is generally reflected across the entire insurance market in New Zealand. The Insurance Council of New Zealand, with its members representing 95% of the market, reports that the insurance industry’s average combined ratio – a key measure of insurer profitability - improved significantly, decreasing from 97.9% in December 2023 to 78.6% in December 2024.

Over this period, we also saw the loss ratios for NZ insurers improve in a number of major sectors:

|

Type of Insurance |

Loss Ration 2023 | Loss Ratio 2024 |

| Commercial Property | 133% | 58% |

| Domestic building and contents | 85% | 51% |

| Motor Vehicle | 74% | 62% |

The graph below shows that between 2023 and 2024 the overall Gross Written Premium in the market grew, but under current conditions this trend is expected to reverse. Meanwhile, both the combined ratio and loss ratios have continued to strengthen, delivering better overall results.

Resilience and innovation

In May 2025 the Reserve Bank of New Zealand (RBNZ) published the results of its 2024 General Insurance Stress Test which gauged the insurance market’s resilience to various scenarios.

It found insurers could pay all policy holder claims even in a severe seismic scenario such as a magnitude 8.7 earthquake, which would exceed the size of the 2010 and 2011 Christchurch events. The RBNZ has also been reviewing its solvency standards to ensure that registered insurance companies have adequate liquidity.

Market conditions have also encouraged insurers to become innovative, and this has already been evident with the two largest insurers. NZI has deployed its capacity into two independent underwriting agencies using technology in the rural and personal lines sectors to enhance its distribution, and Vero’s parent company, Suncorp, has divested its interests in a large bank and life insurance company so it can solely focus on general insurance.

What this means for insurance buyers

All this amounts to good news for most insurance customers. The market is in good shape with plenty of available capacity in most areas, meaning competitive tensions can be generated to drive better outcomes in premium and coverage.

Now is an excellent time to review your insurance needs, so it’s important to engage with your broker early to take full opportunity of these market conditions.

Legislative Changes

Changes to the Resource Management Act (RMA)1991

The Resource Management (Consenting and Other System Changes) Amendment Act 2025 received Royal assent on 20 August 2025. The Amendment Act is a further step in the transition to a new Resource Management system, and the Government has used this to strengthen the RMA compliance and enforcement regime.

The Amendment Act imposes significantly more onerous penalties for environmental offending, placing offences under the RMA within the top tier of fines that can be imposed in New Zealand. These increased penalties include:

- Maximum fines for individuals will increase from $300,000 to $1 million and the maximum term of imprisonment for individuals is decreased from 2 years to 18 months. This reduction means that cases will be judge only and there is no option to elect a jury trial.

- Maximum fines for corporate defendants (e.g. a company) will increase from $600,000 to $10 million.

In addition, a further amendment means it is now unlawful for insurance to pay for any fines imposed under the RMA, which has also been the case with the Health and Safety at Work Act (HSWA) since 2003.

With defendants now having to potentially pay significantly higher penalties out of their own pockets, Statutory Liability insurance cover may be even more important to fund expert legal assistance during investigations and any Court proceedings. As is the case for breaches of the HSWA, a Statutory Liability policy can still cover defence costs arising out of prosecutions under the RMA.

Changes to Fire Service Levies

New Zealand charges a fire levy on property and motor vehicle insurance to fund the operations of Fire and Emergency New Zealand (FENZ), our national body responsible for fire prevention, firefighting, and emergency response services.

FENZ is changing both the rate of the levy, and how it is applied to various types of property, effective 1 July 2026.

For commercial property (non-residential) the rate applied will decrease from 11.95 cents per $100 sum insured to 7.76 cents. However, the basis of calculation will change to apply to the sum insured for the property as opposed to the current basis where levies are charged on the indemnity value. Clients who currently pay levies based on indemnity values will no longer be able to do this after 1 July 2026. So, despite the reduction in FENZ rate, it is likely that where a current indemnity value is less than 65% of the replacement sum insured there will be an increase in the overall levy amount.

There are also various changes to the types of properties that are currently exempt from levies and the application of specific rates and caps to certain types of property such as livestock, forests and aircraft.

Commercial motor vehicles over 3.5 tonnes are currently charged levies based on sum insured at the commercial rate. These will now be charged at a flat rate of $25, and this is also the new rate that will apply to all vehicles regardless of size.

Our brokers are available to assist with advice around all these legislative changes and how they could impact your insurance requirements.

Be sure to engage with your broker to discuss tailored insurance solutions which optimise your coverage and leverage the current market conditions.