Hit enter to search or ESC to close

EQC ups the cover. What the changes mean for you

Recent increases to cover provided by Toka Tu Ake Earthquake Commission (EQC) will now offer Kiwis greater protection in the event of a natural disaster.

The recent increases to cover provided by Toka Tū Ake Earthquake Commission (EQC) will offer New Zealanders greater protection against natural disasters such as earthquake, tsunami, volcanic eruption, hydrothermal activity or natural landslip. But what do these changes actually mean, and what impact will they have on premiums?

Key changes

The amount of cover offered by EQC, which provides natural disaster insurance to residential property owners in New Zealand, was increased by the Government on 1 October 2022. From this date, homeowners will be eligible to receive cover up to $300,000, up from the previous limit of $150,000.

These changes apply to residential dwellings – houses, individual apartments, rest homes, retirement villages and residential body corporates – which must have a fire insurance policy in place to qualify.

Mark Jones, Crombie Lockwood’s Chief Broking Officer, says that for policies already in force at 1 October 2022, the new level of cover will not apply until the policy is renewed.

Mark Jones, Crombie Lockwood Chief Broking Officer

Government expects lower overall premiums

According to EQC Minister The Hon Dr David Clark, the higher EQC cap is designed to ensure that private insurance remains available and affordable.

As the Government will take on a greater portion of risk, its expectation is to see insurers reflect this in their pricing.

Mark Jones says that the Government’s clear expectation that the change will lead to lower premiums highlights a clash between community and risk-based models.

“Unlike EQC’s community pricing model, in which the price of EQC cover is applied equally across region and construction type, commercial insurance companies use risk-based pricing.

This means that the premium they charge reflects the perceived exposure of each individual risk,” says Mark.

Outcomes will vary by region

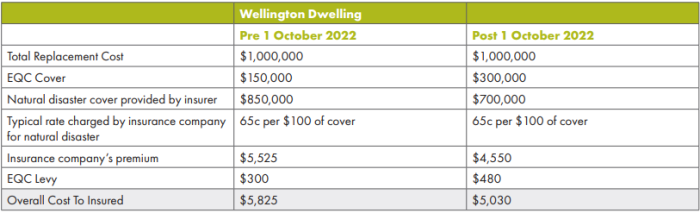

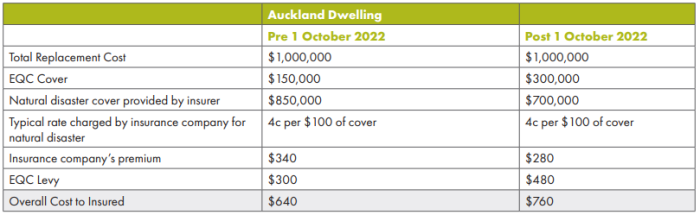

These changes could have different outcomes on insurance costs depending on where the risk is situated, Mark Jones continues.

“As seismic modelling shows that the risk of an earthquake is higher in regions such as Wellington, Hawke’s Bay and Canterbury, insurance companies charge higher premiums in these areas.

“The premium charged for natural disaster insurance in Wellington is significantly higher than in Auckland and so the changes to EQC cover mean the overall price for a policyholder in Wellington could reduce by 14%, whereas in Auckland, it may increase by 19%.

“This means policy holders outside high seismic zones need to be prepared for potential increases in overall insurance costs, as the possible scenarios outlined below show.

“The main insurers in New Zealand haven’t yet confirmed their stance, and we’ll watch this space with interest as it develops over the next 12 months.”

Rates used here are indicative of actual rates applied by insurers but will vary from risk to risk.

Accounting for ‘all other perils’

As well as a natural disaster rate when calculating a premium, insurers apply a rate to cover all other perils such as fire, flood, storms and other weather events.

This means that policyholders in flood-prone and high-risk areas may find that the rise in their ‘all other perils’ premium outweighs any reduction in their natural disaster premium.

As the EQC changes only affect one component of the insurance premiums, the overall effect on insurance costs for dwellings post 1 October 2022 will vary according to the circumstances of individual policyholders.

Get in touch

We recommend discussing the changes with your broker so you are aware of the financial implications.

This information will also assist you with budgeting if the cost is significantly different from the amount you currently pay.

Find a

broker

Published November 2022